Indicators on Offshore Business Formation You Should Know

Table of ContentsSome Of Offshore Business FormationThe Single Strategy To Use For Offshore Business FormationSome Known Details About Offshore Business Formation 3 Simple Techniques For Offshore Business FormationOffshore Business Formation Can Be Fun For AnyoneThe smart Trick of Offshore Business Formation That Nobody is DiscussingExcitement About Offshore Business FormationEverything about Offshore Business FormationFascination About Offshore Business Formation

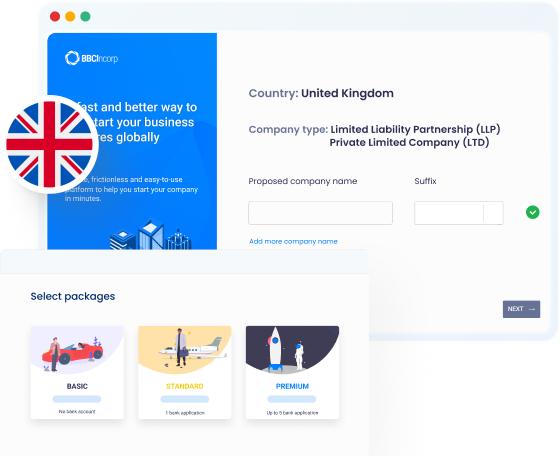

If you aim to do it on your own, you will require to file every little thing and also submit it to the regional firm registrar. Your overseas firm prepares, but that's not adequate to begin business. It needs a place to save its cash when negotiating with customers, customers, and also service companions.An offshore financial institution account is extremely essential since it is the best means to separate your company cash from your individual assets. You can open your firm as well as its savings account in the very same overseas territory. However, many territories permit your company to open up an account in another international country.

Our Offshore Business Formation Diaries

Each financial institution has a various collection of problems to approve your application. If you do not have experience in handling offshore financial institutions, the procedure can obtain very messed up, and also this can lead to undesirable consequences. An expert will help you pick the best bank for your company, typically evaluate your current circumstance, file a well-prepared application, as well as apply it to the financial institution on your part.

As pointed out above, opening an offshore savings account is not a simple task. As well as you will certainly wish to do it in properly. As a result of the problem of using with typical banks, many worldwide local business owner have resorted to a fin-tech remedy. Numerous banks are currently efficient in providing you with a company account that can function simply like a traditional financial institution account.

The Offshore Business Formation Statements

The network of money transfers can go as large as 80+ nations. Multiple money are additionally supported (can go up to 50+ various currencies).

Currently you get the suggestion of an offshore firm and also how to develop it. Making use of overseas companies for trading company purposes is really preferred.

Everything about Offshore Business Formation

You can register your overseas business in one country, obtain products from an additional as well as offer them to a third nation, while managing your firm right at your residence (offshore business formation). When picking a jurisdiction for worldwide trading, right here what you ought to take into consideration: The tax plans The consolidation process and declaring reports The needs for licenses and also allows The target audience as well as other related problems Particular present international guidelines and regulations Hong Kong and also Singapore are 2 fine examples.

These tax obligation treaties bring you lowered tax obligation rates and also tax exemptions on particular type of revenue when it is transferred from one signing country to one more. Hong Kong is the gateway to a big potential market in China. Singapore has one of the finest financial systems as well as financial solutions in the world.

How Offshore Business Formation can Save You Time, Stress, and Money.

Your overseas company can hold a number of shares in another international firm and receive returns as a primary income. It can also hold other kinds of properties like patents and also trademarks, rent them or offer them overseas to make profits. For holding company, you should think about nations with solid intellectual building (IP) regimes to guarantee personal privacy as well as protection for your assets.

Lots of territories do not permit crypto-related activities. And also opening up a savings account for a crypto company can be a genuine discomfort. The overseas setting has actually altered a great deal. This is an arise from the practices of the EU and the OECD during current years. offshore business formation. To straighten with the accepted EU criterion, there has been a massive change with respect to the taxation as well as business legislation in some landscapes where we typically called "offshore" jurisdictions.

Offshore Business Formation Can Be Fun For Anyone

Gone are the days when an International Service Business in lots of conventional monetary hubs like Saint Vincent as well as The Grenadines are ring-fenced. Nowadays you can find that both homeowners as well as non-residents obtain the right to start company with this home type of business, and also they can trade with regional residents too (offshore business formation).

Some Known Incorrect Statements About Offshore Business Formation

Keeping that stated, there are anti money laundering laws that will cause specialists assessing structures. offshore business formation. Most jurisdictions will not divulge who created the overseas companies, especially the owner's names, to any 3rd party or international government. This is, unless, of course, an act of criminal wrong or, in recent times, terrorism, has taken location and also is being explored.

A Biased View of Offshore Business Formation

Your possessions can be shielded from lawful opponent, judges as well as court rulings click here to find out more merely by integrating offshore. Most overseas jurisdictions make it basic on anybody that is interested in integrating.

We aid in your technique and creating a solution prepare for your requirements.

The Greatest Guide To Offshore Business Formation

Offshore companies are organization entities created beyond the jurisdiction of the United States. They can be utilized as a reliable tool for avoiding taxes and also laws. They are also utilized by offenders to launder cash and also avoid prosecution. An offshore business is a lawful entity that does not have any type of physical visibility in the U.S. There is no other way to link you to the business if there is ever a problem. You own whatever regarding your company its name, address, savings account, workers, etc. Nobody has accessibility to them except you. If something occurs to your business, you lose just time. You can alter the ownership structure whenever you want.