Unlock the Perks: Offshore Trust Fund Services Explained by an Offshore Trustee

Offshore trust fund services have ended up being progressively prominent among people and businesses looking for to optimize their monetary techniques. From the fundamentals of overseas trust funds to the complexities of tax obligation planning and property security, this guide discovers the numerous advantages they provide, consisting of enhanced privacy and confidentiality, adaptability and control in wide range administration, and access to worldwide financial investment chances.

The Fundamentals of Offshore Depends On

The fundamentals of offshore trust funds include the facility and management of a count on a territory outside of one's home nation. Offshore trusts are frequently utilized for possession protection, estate planning, and tax optimization purposes. By placing possessions in a count on located in an international territory, people can guarantee their assets are secured from potential threats and responsibilities in their home country.

Establishing an offshore trust generally needs involving the solutions of an expert trustee or trust business who is fluent in the legislations and laws of the chosen jurisdiction. The trustee acts as the lawful owner of the properties kept in the depend on while handling them according to the terms laid out in the trust act. offshore trustee. This setup supplies an added layer of protection for the properties, as they are held by an independent 3rd party

Offshore trust funds provide numerous advantages. They can supply enhanced personal privacy, as the details of the trust and its recipients are usually not publicly revealed. They use potential tax advantages, as certain jurisdictions may have much more positive tax obligation routines or supply tax obligation exemptions on specific kinds of revenue or possessions held in count on. Offshore trust funds can assist in efficient estate planning, enabling people to pass on their wealth to future generations while minimizing inheritance tax liabilities.

Tax Planning and Property Protection

Tax obligation planning and asset protection play an essential role in the strategic application of offshore depends on. Offshore trusts supply individuals and companies with the possibility to reduce their tax obligations legally while protecting their assets. One of the main benefits of making use of offshore trust funds for tax obligation preparation is the ability to benefit from beneficial tax routines in international jurisdictions. These jurisdictions typically supply lower or zero tax obligation rates on certain kinds of revenue, such as resources gains or rewards. By establishing an offshore count on among these organizations, jurisdictions and individuals can dramatically lower their tax problem.

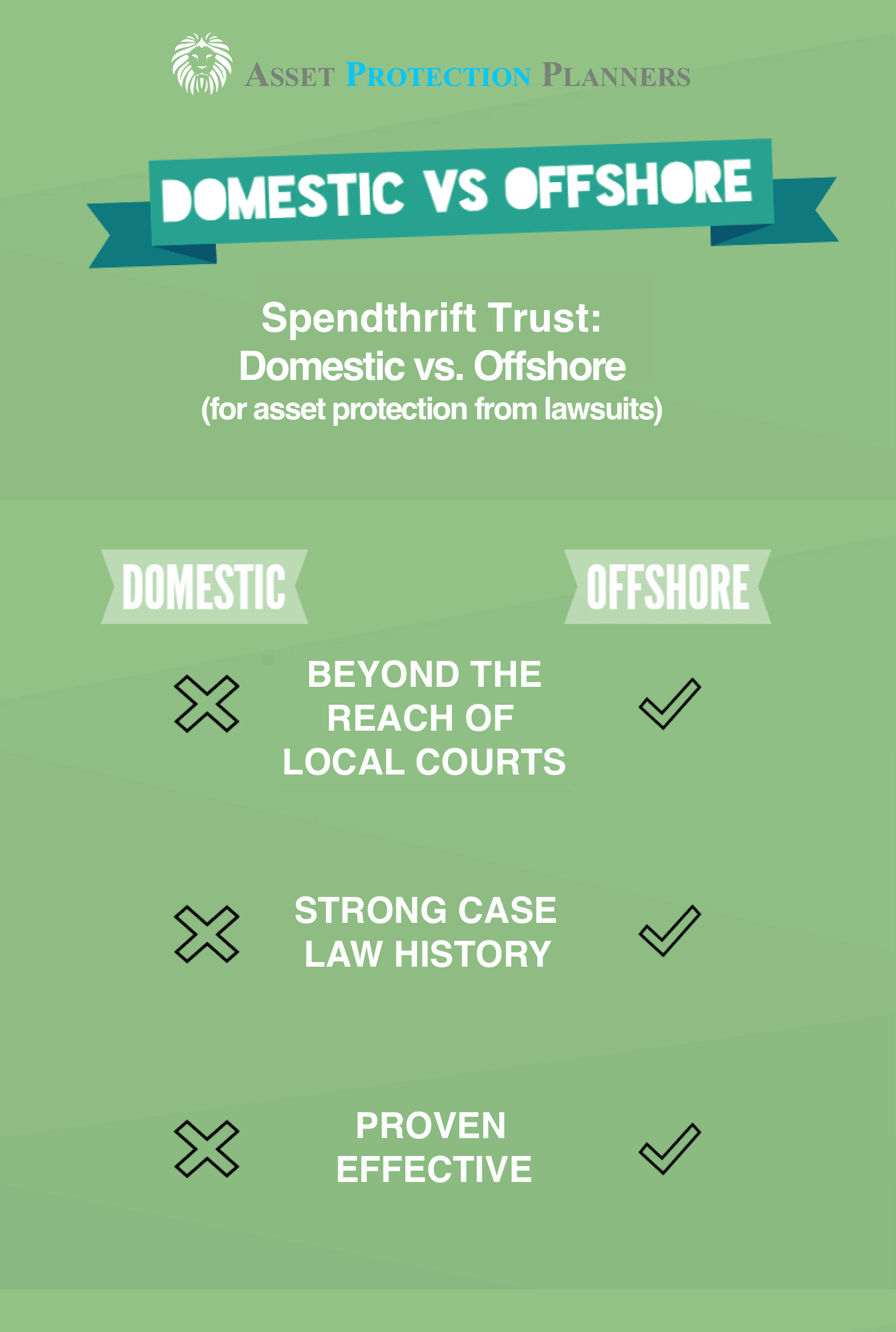

Asset protection is an additional vital facet of offshore depend on solutions. Offshore depends on supply a robust layer of security versus prospective risks, such as suits, financial institutions, or political instability. By transferring possessions right into an overseas trust, people can shield their riches from possible lawful cases and guarantee its conservation for future generations. Furthermore, offshore depends on can provide privacy and personal privacy, more securing properties from spying eyes.

However, it is very important to keep in mind that tax obligation preparation and possession defense should always be conducted within the bounds of the law. Participating in prohibited tax evasion or deceptive asset security techniques can bring about extreme consequences, consisting of fines, penalties, and damages to one's reputation. As a result, it is necessary to seek specialist advice from seasoned overseas trustees that can direct people and companies in structuring their overseas count on a compliant and honest manner.

Enhanced Personal Privacy and Confidentiality

Enhancing personal privacy and discretion is an extremely important purpose when utilizing offshore trust services. Offshore counts on are renowned for the high degree of privacy and privacy they supply, making them an eye-catching choice for navigate here businesses and individuals seeking to protect their properties and monetary details. Among the essential benefits of offshore trust solutions is that they provide a legal structure that permits people to maintain their economic affairs exclusive and secured from spying eyes.

The improved personal privacy and confidentiality provided by offshore trusts can be specifically helpful for individuals that value their privacy, such as high-net-worth people, celebrities, and specialists looking for to shield their assets from possible claims, lenders, or even household disputes. By using offshore trust solutions, individuals can keep a greater level of privacy and confidentiality, allowing them to guard their wealth and economic passions.

Nevertheless, it is vital to note that while offshore trusts provide enhanced privacy and privacy, they need to still abide by appropriate regulations and guidelines, including anti-money laundering and tax reporting requirements - offshore trustee. It is critical to deal with experienced and reputable lawful professionals and offshore trustees who can guarantee that all legal obligations are satisfied while maximizing the personal privacy and confidentiality benefits of overseas trust services

Flexibility and Control in Wealth Administration

Offshore counts on supply a substantial degree of flexibility and control in riches monitoring, permitting organizations and learn the facts here now people to effectively handle their properties while keeping personal privacy and discretion. One of the vital advantages of overseas trusts is the ability to tailor the trust fund structure to meet details demands and purposes. Unlike conventional onshore counts on, offshore trust funds offer a variety of choices for property protection, tax obligation planning, and succession planning.

With an offshore trust, companies and individuals can have greater control over their riches and exactly how it is managed. They can pick the jurisdiction where the count on is developed, enabling them to capitalize on desirable legislations and policies. This adaptability enables them to maximize their tax obligation setting and protect their properties from potential threats and responsibilities.

In addition, offshore counts on use the alternative to appoint professional trustees who have considerable experience in taking care of intricate counts on and browsing international policies. This not just makes certain reliable wealth management but also provides an added layer of oversight and protection.

Along with the adaptability and control offered by offshore trust funds, they also provide discretion. By holding possessions in an offshore territory, services and individuals can protect their monetary info from spying eyes. This can be particularly beneficial for high-net-worth individuals and organizations that value their privacy.

International Investment Opportunities

International diversity provides individuals and services with a multitude of investment possibilities to expand their profiles and alleviate dangers. Investing in global markets enables capitalists to access a bigger range of property classes, sectors, and geographical regions that might not be readily available locally. By expanding their investments across various nations, investors can minimize their direct exposure to any single market or economy, therefore spreading their dangers.

One of the vital advantages of international investment opportunities is the possibility for greater returns. Different nations may experience varying economic cycles, and by purchasing numerous markets, capitalists can maximize these cycles and potentially accomplish higher returns contrasted to investing entirely in their home nation. Additionally, investing worldwide can likewise supply accessibility to arising markets that have the possibility for rapid economic growth and higher investment returns.

Additionally, international financial investment opportunities can offer a bush against currency danger. When purchasing international currencies, financiers have the potential to take advantage of currency changes. If a capitalist's home currency compromises against the currency of the foreign investment, the returns on the investment can be intensified when converted back to the capitalist's home money.

Nonetheless, it is very important to note that investing internationally likewise comes with its very own collection of risks. Political instability, governing changes, and geopolitical uncertainties can all impact the efficiency of global financial investments. It is essential for financiers to carry out comprehensive study and seek specialist advice before venturing into international financial investment opportunities.

Final Thought

The basics of offshore trusts involve the facility and administration of a depend on in a territory outside of one's home country.Developing an overseas count on normally requires involving the services of a professional trustee or count on company that is skilled in the regulations and guidelines of the chosen jurisdiction (offshore trustee). The trustee acts as the lawful proprietor of the possessions held in the trust while managing them in accordance with the terms set out in the trust fund act. One of the key advantages of offshore trusts is the capability to tailor the depend on structure to fulfill certain requirements and goals. Unlike conventional onshore counts on, offshore trusts provide a vast array of alternatives for possession security, tax obligation preparation, and sequence preparation